Best RV Rental Insurance: Everything You Need to Know

Last updated on August 17th, 2023 at 04:47 am

Youwill surely need the Best RV Rental Insurance If you are planning a remarkable and unforgettable RV adventure? Renting an RV can offer us an extraordinary opportunity to explore new and exciting destinations, create cherished and lasting memories with our loved ones, and experience the exhilarating freedom of the open road.

However, just like any other vehicle, it is of utmost importance for us to prioritize and ensure that we have comprehensive insurance coverage to safeguard ourselves, our passengers, and our valuable investment in the RV.

Our Top RV Insurers

Roamly – Best Overall RV Insurance – Get more RV coverage for up to 35%* less

The best RV Loan Calculator can be found here if you haven’t figured out how to pay for the Vehicle

Understanding RV Rental Insurance

Before we delve into the different types of RV rental insurance, it’s crucial to understand its purpose. RV rental insurance provides financial protection in case of accidents, damages, theft, or injuries that occur during your rental period.

This coverage helps mitigate potential liability and financial losses, allowing you to enjoy your RV adventure with peace of mind.

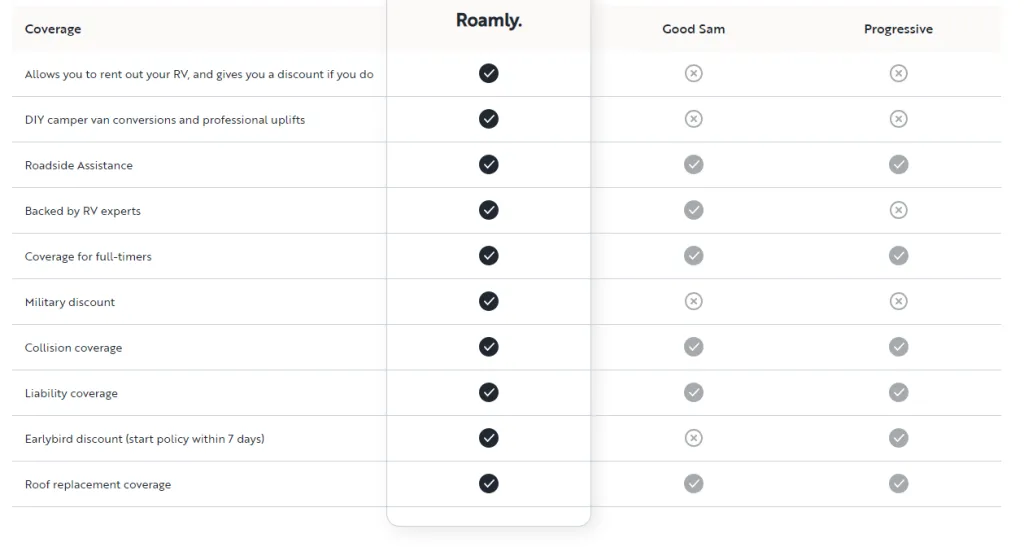

Roamly: Best Overall RV Insurance

What does the cover look like?

Let me present you with a concise overview of the leading insurance option. With a solid reputation, backed by over 200 positive reviews, this company has emerged as one of the finest providers of recreational vehicle insurance in the USA.

Total loss replacement

If your RV is no more than 5 model years old and it is totaled or stolen, it will be replaced with a comparable new model.

Storage coverage

Their exclusive Storage Coverage can cut their premium in half by suspending the coverages, such as liability and collision, they don’t need when their RV isn’t in use.

Full-time coverage

If one lives in their RV for 6+ months a year, this plan functions as a homeowners policy, providing coverage for personal liability and medical payments.

Personal effect coverage

They cover the full replacement cost of your personal belongings in your RV. Everything from laptops and linens, to hammocks and hiking sticks, up to $3,000.

Emergency expense coverage

They cover lodging, transportation, and meal expenses if your RV is inoperable due to a covered loss and you’re more than 50 miles from home.

Vacation liability coverage

Gets up to $300,000 worth of protection for incidents like slip-and-falls and campfire-related losses. Vacation Liability Coverage keeps you safe wherever the road takes you.

Customer reviews

Impressive customer service

The customer service is outstanding. My agent is Santiago Lubo, he was helpful, informative and clear on his explanations. I am new to this company, but already very impressed

Date of experience: July 06, 2023

In mid-May, our 5th wheel suffered a significant impact with a boulder, resulting in damage to the entire back end. Thanks to the prompt and efficient repairs by the repair place, we were able to continue living in our home seamlessly as full-time travelers. The repairs were completed by the first week of June, with all necessary parts ordered and fitted. Throughout the process, Roamly provided excellent assistance, ensuring that we were well-informed every step of the way. We greatly appreciated their quick responses and exceptional service quality.

Theresa

The Different Types of RV Rental Insurance

When it comes to RV rental insurance, there are several types of coverage available. Let’s explore each of them in detail.

Liability Insurance

Liability insurance is the most basic and essential coverage for RV rentals. It protects you if you cause property damage or bodily injury to others while operating the rented RV.

This coverage typically includes both property damage liability and bodily injury liability.

Collision Insurance

Collision insurance covers damages to the rented RV caused by a collision with another vehicle or object, regardless of fault.

It ensures that you won’t be financially responsible for repairs or replacement if an accident occurs.

Comprehensive Insurance

Comprehensive insurance provides coverage for non-collision incidents, such as theft, vandalism, fire, or weather-related damages. It safeguards your rented RV from various risks and gives you peace of mind knowing that you’re protected against unexpected events.

Personal Injury Protection (PIP)

Personal Injury Protection, commonly known as PIP, covers medical expenses for you and your passengers if you’re injured in an accident. It may also include benefits for lost wages and other related costs.

Additional Coverage Options

In addition to the primary types of RV rental insurance, there are several additional coverage options that you may consider for enhanced protection during your RV adventure.

Roadside Assistance

Roadside assistance coverage provides support and assistance if your rented RV breaks down or if you encounter mechanical issues during your trip.

This coverage typically includes services like towing, fuel delivery, tire changes, and lockout assistance. Having roadside assistance can save you from unexpected expenses and help you get back on the road quickly.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you in case you’re involved in an accident with a driver without insurance or insufficient coverage.

This type of coverage ensures that you’re financially protected even if the other party is unable to cover the damages.

Contents Coverage

Contents coverage is an option worth considering if you plan to bring personal belongings or valuable items with you on your RV trip.

This coverage protects your personal belongings from theft, damage, or loss while inside the rented RV.

Factors Affecting RV Rental Insurance Costs

Several factors influence the cost of RV rental insurance. Understanding these factors can help you make informed decisions while choosing insurance coverage for your rental.

RV Type and Value

The type and value of the RV you’re renting play a significant role in determining insurance costs. Generally, larger and more expensive RVs will have higher insurance premiums due to their increased replacement or repair costs.

Driving Experience and Record

Your driving experience and record also impact the insurance costs. You may qualify for lower insurance rates if you have a clean driving record with no accidents or traffic violations. On the other hand, a history of accidents or tickets could result in higher premiums.

Location and Duration of Rental

The location where you plan to rent the RV and the duration of your rental period can affect insurance costs.

Some areas may have higher accident rates or increased risk factors, leading to higher premiums.

Additionally, longer rental periods may result in higher insurance costs due to an extended coverage duration.

Tips for Finding the Best RV Rental Insurance

Finding the best RV rental insurance requires careful consideration of different factors. Here are some tips to help you navigate the process:

Research Different Insurance Providers

Take the time to research and compare insurance providers that offer RV rental coverage. Look for reputable companies with positive customer reviews and a track record of excellent customer service.

Compare Coverage and Costs

Compare the coverage options and costs offered by different insurance providers. Look for a policy that provides adequate coverage for your specific needs at a reasonable price.

Read Reviews and Seek Recommendations

Reading reviews and seeking recommendations from fellow RV travelers can provide valuable insights into the quality of insurance providers.

Pay attention to customer experiences, claims processes, and overall satisfaction.

Understand Policy Exclusions and Limitations

Carefully read and understand the policy exclusions and limitations before making a decision. Ensure that the coverage aligns with your requirements and that you’re aware of any restrictions or conditions that may apply.

What to Do in Case of an Accident

While we hope you never have to experience an accident during your RV rental journey, it’s essential to know what steps to take if the unfortunate occurs. Here’s a guide on what to do in case of an accident:

Stay Calm and Ensure Safety

Remain calm and ensure the safety of yourself, your passengers, and others involved. If possible, move your RV to a safe location, and turn on hazard lights to alert other drivers.

Document the Incident

Gather necessary information by documenting the accident scene. Take photos of the damages, exchange contact and insurance details with other parties involved, and gather any witness statements if available. This documentation will be crucial when filing an insurance claim.

Contact the Rental Company and Insurance Provider

Notify the rental company about the accident as soon as possible. They will guide you through their specific procedures and may provide further instructions.

Contact your insurance provider to report the incident and initiate the claims process. Provide them with all the relevant information and cooperate fully throughout the process.

Frequently Asked Questions (FAQs)

Let’s address some commonly asked questions regarding RV rental insurance:

Is RV rental insurance mandatory?

While RV rental insurance is not always mandatory, it is highly recommended to have adequate coverage to protect yourself and your investment.

Can I use my personal auto insurance for RV rentals?

It depends on your personal auto insurance policy. Some policies may provide limited coverage for RV rentals, but it’s crucial to review the terms and conditions of your policy and consult with your insurance provider to ensure you have the necessary coverage.

How much does RV rental insurance cost?

The cost of RV rental insurance can vary depending on various factors, including the type of RV, coverage options, rental location, duration, and your driving history. It’s best to obtain quotes from multiple insurance providers to compare costs.

What happens if I decline rental insurance?

If you decline rental insurance, you may be personally responsible for any damages, theft, or injuries that occur during your rental period. It’s important to carefully consider the risks and weigh the potential financial consequences before making a decision.

Does RV rental insurance cover towing?

RV rental insurance typically does not cover towing unless it is explicitly mentioned in the policy. However, some insurance providers may offer optional towing or roadside assistance coverage.

Can I add additional drivers to my RV rental insurance?

Many insurance providers allow you to add additional drivers to your RV rental insurance policy. However, certain conditions or restrictions may exist, such as age limitations or requirements for all drivers to be listed on the rental agreement. Check with your insurance provider for specific details.

Final Thoughts

We believe that Securing RV rental insurance is a vital step towards a safe and worry-free journey.

Securing insurance for your RV rental is a crucial measure to ensure a safe and worry-free journey. We firmly believe that taking this step is paramount in safeguarding your adventure.

Thank you for joining us in this comprehensive guide on RV rental insurance. If you have any further questions or need assistance, feel free to reach out to us. Happy travels!

This article is provided for informational purposes only and should not be considered legal or insurance advice. Consult with a qualified insurance professional for guidance specific to your situation.

- RV Rental Bethel OH - December 13, 2023

- RV Rental Broadview Heights OH - December 13, 2023

- RV Rental Beloit OH - December 13, 2023